Wondered about UTR number for upi transaction? Know the role of UTR numbers in UPI transactions, how they track, verify, and ensure secure payments.

Have you ever made a payment using UPI (Unified Payments Interface) and wondered about the mysterious 12-digit number, mentioned in the confirmation message? That, my friend, is your UTR number (Unique Transaction Reference number), and it’s more important than you might think.

UPI, the Unified Payments Interface, has revolutionized digital payments in India. But with its fast and convenient transactions comes a need for clarity and understanding. One key element that often confuses users is the UTR number. What is it? Where do you find it? And why is it important? Worry not, This article will answer all your questions about the UTR number for UPI transaction. Keep reading.

What is a UTR Number?

UTR, short for Unique Transaction Reference, is a unique code assigned to every transaction made through the Indian banking system. It’s like a special fingerprint for your payment, allowing you to track its status and resolve any issues that might arise. While UPI transactions primarily use 12-digit reference numbers for tracking within the UPI app itself, the UTR number provides a more comprehensive record across the entire banking system.

Think of it this way: when you send money via UPI, it travels through a network of banks before reaching the recipient. The UTR number serves as a special tag attached to your payment, ensuring it reaches the right destination and can be easily tracked in case of any issues.

Why is The UTR Number Important? What are UTR Numbers Used For?

Here’s why the UTR number holds significance:

- Tracking Transactions: If your payment gets stuck or delayed, the UTR number helps you and your bank trace its whereabouts. By sharing the UTR number with your bank, they can investigate the issue and resolve it faster.

- Reconciliation: Banks use UTR numbers to match debits and credits in your account, ensuring everything is accounted for accurately.

- Dispute Resolution: In case of any discrepancies or disputes regarding a UPI transaction, the UTR number serves as crucial evidence for both parties involved.

- File complaints: If you encounter issues, you can file a complaint with the NPCI or your bank using the UTR number.

- Tax Filing: If you’re making business-related transactions through UPI, the UTR number is crucial for maintaining accurate records and claiming tax deductions.

Where to Find The UTR number?

Finding your UTR number is usually quite easy. It depends on how you made the transaction. Here are some common ways:

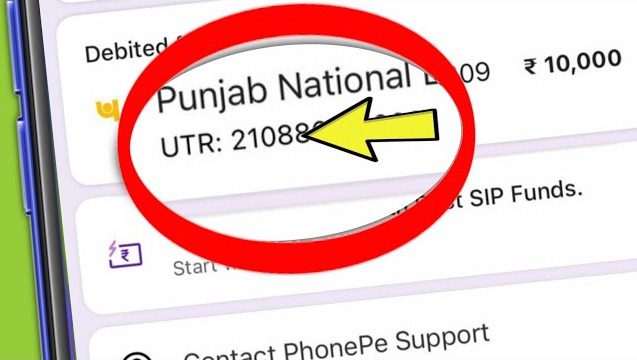

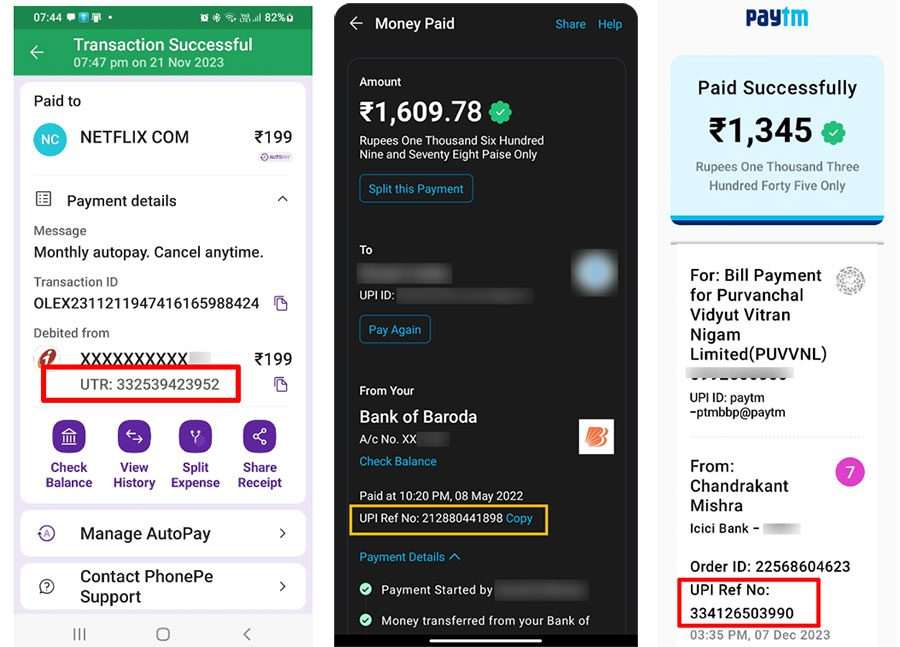

- UPI App: Look for the transaction history in your preferred UPI app (PhonePe, Google Pay, Paytm, etc.). The UTR number might be displayed directly or accessible by tapping on the specific transaction details.

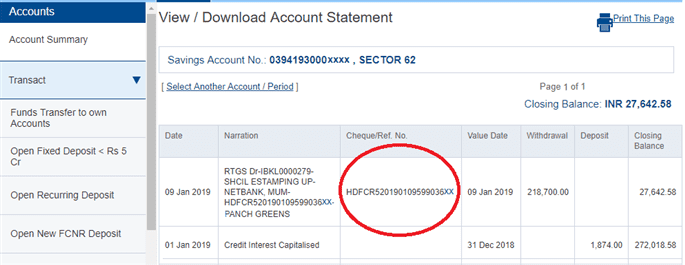

- Bank Statement: Your bank statement (online or physical) will also show the UTR number associated with your UPI transactions. Look for the transaction date and amount, and the UTR number should be mentioned nearby.

- SMS/Email Confirmation: Depending on your bank and chosen UPI app, you might receive an SMS or email confirmation containing the UTR number after a successful transaction.

UTR Number vs. UPI Reference Number: What’s the Difference?

Are UTR Numbers the Same as UPI Reference Numbers? No, although both serve as identifiers for your transactions, they differ. A UPI reference number is typically a 12-digit code unique to each specific UPI transaction within your chosen app. While it allows you to track the transaction within the app itself, it’s not as universally recognized as the UTR number, which functions across the entire banking system. Both are valuable for tracking purposes, but only the UTR number can be used for official inquiries and dispute resolution.

| Feature | UTR Number | UPI Reference Number |

|---|---|---|

| Purpose: | Track inter-bank transactions | Track UPI payments |

| Assigned by: | Bank | UPI system |

| Transactions: | NEFT, RTGS, IMPS | Real-time, peer-to-peer |

| Length: | Varies | 12 digits |

| Where to find: | Bank statements, receipts, confirmations | UPI app history, confirmation screen |

How to Track The Transaction Status Using UTR Number?

Tracking your transaction using a UTR number is easy! Here are two methods:

- For UPI Transactions: Most UPI apps like PhonePe, Paytm, and Google Pay display the UTR number within the transaction history section. You can locate the specific transaction and view its associated UTR number.

- Banking Apps/Websites: Most banks allow you to track transactions directly through their mobile app or website. Log in to your online banking portal or mobile app. Look for the “Transaction History” or “Statement” section and search for the specific payment using the UTR number. The status will be displayed, indicating whether it’s successful, pending, or failed.

- For Bank Transfers: Check your bank statement (online or physical) for the transaction details. The UTR number will be mentioned alongside the transaction information.

- Contact Your Bank’s Customer Care: If you’re unable to access your online banking, reach out to your bank’s customer care via phone or email. Provide them with the UTR number, and they’ll be happy to assist you with tracking its status.

UTR Number for NEFT and RTGS Transactions:

While UPI transactions typically have their own 12-digit reference number, UTR numbers also play a vital role in other bank transfers like NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement). These transactions also have unique UTR numbers that function similarly to track and manage payments.

UTR Numbers in PhonePe, Paytm, and Google Pay:

These popular UPI payment platforms readily provide UTR numbers for your transactions. Here’s how to find them:

- PhonePe: Open the app, tap “My Money” > “Transactions“. Choose the specific transaction and view its details. The UTR number will be displayed.

- Paytm: Open the app, tap “Wallet” > “Statements“. Select the transaction and click “View Details“. The UTR number will be visible.

- Google Pay: Open the app, tap “Activity“. Choose the transaction and tap “View details”. The UTR number will be shown.

How Can I Find the UTR Number in UPI Transaction?

Finding your UTR number depends on the type of transaction:

- For UPI transactions: Look for the “Transaction ID” or “Reference number” in your UPI app’s history section. It’s usually a 12-digit code, not the UTR number.

- For Phonepe, Paytm, or Google Pay: Look for the specific transaction in your app’s history and search for “UTR number” or “Transaction ID.” However, remember that these apps primarily use their own reference numbers for UPI transactions.

- For NEFT or RTGS transactions: Check your bank statement or online banking portal. The UTR number will be listed near the transaction details.

Is it Safe to Share a UTR Number?

Sharing your UTR number with trusted entities like your bank or customer care is perfectly safe. They require it for legitimate purposes like tracking transactions or resolving disputes. However, exercise caution when sharing it with unknown individuals or websites. While the UTR number itself doesn’t expose sensitive information like your bank account details, it can be used to track your transaction history. However, it’s always wise to be cautious:

- Only share your UTR number with trusted individuals or institutions, like your bank or the intended recipient in case of disputes.

- Avoid sharing it on public forums or websites or with anyone you don’t trust implicitly.

- If you’re unsure, contact your bank for guidance.

Bonus Tip: UTR Number and Taxes

If you’re a business owner, the UTR number plays a crucial role in tax compliance. It helps you link payments with invoices and maintain accurate financial records. You can also use the UTR number to claim tax deductions for eligible business expenses.

Conclusion

Understanding the UTR number in UPI transaction empowers you to make informed decisions and handle your UPI transactions smoothly. Remember, it’s your unique identifier in the world of digital payments, ensuring transparency and security. So, the next time you use UPI, keep this handy guide in mind and navigate your financial journey with confidence!

So, the next time you make a UPI transaction, remember the UTR number. It’s a small code with big benefits!

Hi I am Harish. I am a blogger, writer. I am also a photographer. I love to share my thoughts and experiences through the words in my blog. Thank you.