Discover the 10 leading Buy Now Pay Later apps in India for seamless shopping experiences. Enjoy the freedom to shop now and pay later with our expert guide.

Over the past few years, Buy Now Pay Later (BNPL) services have become immensely popular in India, offering consumers a convenient and flexible way to shop without immediate payment. These services allow users to defer payments for their purchases and settle them later, often in installments, making it an attractive option for those who wish to manage their finances more effectively or spread out the cost of larger purchases.

As the demand for BNPL services continues to grow, several players have entered the Indian market, each offering unique features and benefits. In this guide, we’ll explore the top 10 Buy Now Pay Later apps in India, providing a comprehensive overview to help you make informed choices based on your preferences and needs.

Understanding Buy Now Pay Later:

Buy Now Pay Later (BNPL) is a modern payment solution that allows consumers to make purchases and defer the payment to a later date. Unlike traditional credit cards, BNPL services often do not require a credit check and offer flexible repayment options. This makes it an attractive choice for those who might not have a credit card or prefer an alternative to traditional financing.

You May Also Read: What is No Cost EMI? How it Works Amazon, Flipkart or Credit Cards?

Is ‘Buy Now Pay Later’ Right for You?

BNPL is suitable for those who are sure they can make repayments as per the company’s rules. If you miss payments, you might face extra charges, and they could be more than you expect. Remember, not paying on time can harm your credit score, making it hard to get loans later.

You might find BNPL useful if:

- You have a regular salary or income.

- Business owners who need quick funds.

- You want to boost your credit score.

- You prefer cashless transactions, paying the service provider later.

But, BNPL is not a good idea if:

- Your income is uncertain.

- You don’t expect a regular flow of money.

- In these cases, consider personal loans with specific criteria and requirements instead.

10 Best Buy Now Pay Later Apps in India

There are a number of BNPL apps available in India, each with its own features and benefits. Here are the 10 best BNPL apps in India:

1. Paytm Postpaid: Unlocking Credit with Paytm

Paytm Postpaid is a widely used BNPL app in India, offering interest-free credit up to Rs. 50,000. This app provides instant credit approval, allowing users to make purchases across various merchants, including e-commerce platforms, grocery stores, and pharmacies. With its broad acceptance network, Paytm Postpaid is a convenient option for those looking for quick and hassle-free credit.

2. ZestMoney: Flexible Financing for All

ZestMoney stands out as a popular BNPL provider with a variety of credit options, including instant loans, flexible payment plans, and point-of-sale financing. Known for its quick loan approval process and wide acceptance network, ZestMoney caters to diverse financial needs, making it a preferred choice for many users seeking flexibility in their payments.

3. Amazon Pay Later: Convenient Shopping on Amazon

Amazon Pay Later is a user-friendly BNPL option for Amazon shoppers. This service enables users to make purchases on Amazon and defer payments in installments. With interest-free credit available for a limited period, Amazon Pay Later provides a convenient solution for those who frequent the e-commerce giant for their shopping needs.

3. LazyPay: Instant Credit, Simple Process

LazyPay is a user-friendly BNPL app providing instant credit up to Rs. 1 lakh. With its straightforward and transparent payment process, LazyPay allows users to make purchases across a wide range of merchants, ensuring a seamless experience for those seeking hassle-free credit options.

5. Flipkart Pay Later: E-commerce Convenience with Flipkart

Flipkart Pay Later, offered by one of India’s leading e-commerce platforms, allows users to make purchases on Flipkart and pay for them later in installments. With interest-free credit available for a limited period, this BNPL service caters specifically to Flipkart’s vast customer base, offering a convenient payment solution.

6. Simpl: Instant Credit, Simplified Process

Simpl is a popular BNPL provider offering instant credit up to Rs. 10,000. Known for its user-friendly interface, Simpl has a wide acceptance network, making it a convenient option for users looking for simplicity and ease in managing their payments.

7. ePayLater: BNPL for Small and Medium-sized Businesses (SMBs)

ePayLater focuses on providing BNPL solutions to small and medium-sized businesses (SMBs). With flexible payment plans and competitive interest rates, this app caters to the unique needs of businesses seeking convenient and accessible credit options.

8. Mobikwik Zip Pay Later: Digital Wallet, Flexible Payments

Mobikwik Zip Pay Later, offered by the popular digital wallet Mobikwik, provides instant credit up to Rs. 25,000. With the flexibility to make purchases across various merchants, Mobikwik Zip Pay Later offers a convenient BNPL solution for users familiar with the Mobikwik digital ecosystem.

9. CASHe Pay Later: Instant Credit with Cashback Rewards

CASHe Pay Later is a BNPL service offering instant credit up to Rs. 20,000. What sets it apart is its unique feature that allows users to earn cashback on their purchases, adding an extra layer of savings to the convenience of deferred payments.

10. Uni Paycheck: Salaried Employees’ Financial Partner

Uni Paycheck focuses on providing credit to salaried employees, offering instant credit up to Rs. 1 lakh. With the option to repay loans through salary deductions, Uni Paycheck provides a tailored BNPL solution for individuals with a regular income.

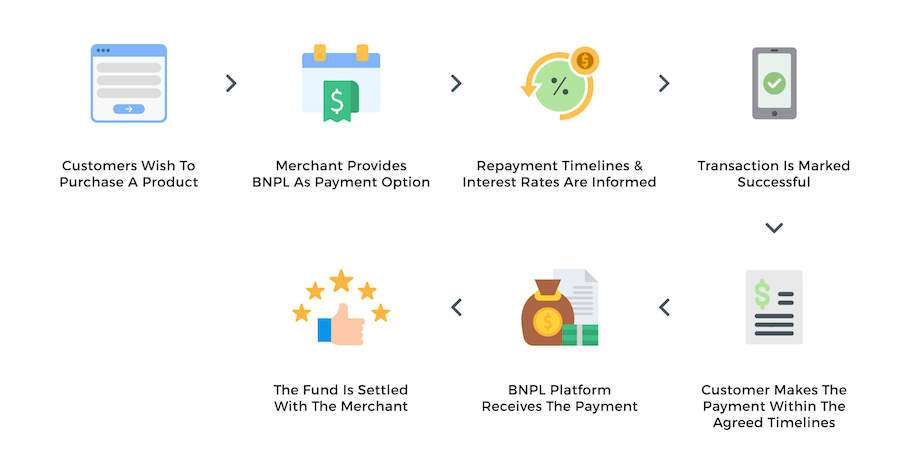

How ‘Buy Now Pay Later’ typically works in India:

- Choose a BNPL provider: Several BNPL providers operate in India, including ZestMoney, LazyPay, Simpl, Amazon Pay Later, Ola Money Postpaid, Paytm Postpaid, Flexmoney, EPayLater, and Capital Float.

- Create an account: Sign up for an account with your chosen BNPL provider. This usually involves providing your personal information, such as your name, phone number, and email address.

- Set your spending limit: BNPL providers may assign you a spending limit based on your creditworthiness. This limit determines the maximum amount you can spend using BNPL.

- Shop at participating merchants: Look for the BNPL option at checkout when shopping at a participating merchant. Select your preferred BNPL provider and payment plan.

- Complete your purchase: Once you’ve selected BNPL, complete your purchase as usual. You’ll receive a confirmation from the BNPL provider with details about your payment plan.

- Make your payments: Make your payments on time according to your agreed-upon schedule. Some BNPL providers may automatically deduct payments from your linked bank account.

Benefits of Buy Now Pay Later in India:

- Convenience: Spread out the cost of purchases, making them more affordable.

- Flexibility: Choose payment plans that suit your budget and financial situation.

- Enhanced shopping experience: Impulse purchases become easier, leading to increased sales for merchants.

- Financial inclusion: Provides access to credit for customers with limited or no credit history.

Risk of Buy Now Pay Later:

- Potential for overspending: Easy access to credit can lead to overspending and financial distress.

- Late payment fees: Late payments may incur additional fees, increasing the overall cost of the purchase.

- Impact on credit score: Overuse of BNPL may negatively affect your credit score.

- Limited regulation: The BNPL industry in India is still evolving, and regulatory oversight is relatively limited.

Overall, Buy Now, Pay Later offers a convenient and flexible payment option for Indian consumers, but it’s crucial to use it responsibly and understand the potential risks.

Things to Keep in Mind

Before opting for Buy Now Pay Later (BNPL), consider these key points:

- EMI Schedule:

- EMIs are interest-free for an initial period.

- Paying within this timeframe avoids interest charges.

- After this period, nominal interest is applied, but it’s generally lower than other lending tools.

- Precaution:

- Timely EMI payments are crucial to maintain a good credit rating.

- Defaulting can negatively impact your credit score.

- Boost to Credit Score:

- BNPL usage can enhance your credit score over time.

- Even those with poor credit scores may access this facility.

- Regular EMI payments contribute to a better credit rating.

- Where to Use:

- BNPL can be used at partner companies of the service provider.

- More partner companies provide a better experience for consumers.

- Charges:

- Interest is waived if payments or EMIs are made on time.

- Late payments incur interest charges, often higher than personal loans.

- Most BNPL companies have no annual fees, and joining fees are rare.

Conclusion:

These are just a few of the many BNPL apps available in India, each catering to different needs and preferences. When choosing the best BNPL app for you, consider factors such as credit limits, interest rates, repayment options, and the merchant acceptance network. Whether you’re a frequent shopper, a business owner, or a salaried employee, these BNPL apps offer a range of solutions to make your financial transactions more convenient and flexible. Happy shopping!

Data Source: www.forbes.com/advisor/in/personal-loan/buy-now-pay-later-apps/

Hi I am Harish. I am a blogger, writer. I am also a photographer. I love to share my thoughts and experiences through the words in my blog. Thank you.